This information is based on statistical studies.

The COP is specifically governed by Drivers (Movements in Other Markets) and Fundamentals (News that are happening or that happen on the same market day).

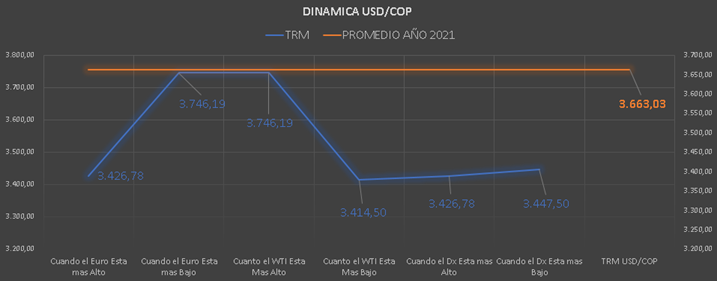

3 Drivers that impact your performance on a daily basis:

- WTI (Oil): When it rises, the COP falls and vice versa.

- Euro Vs. Usd: When the Euro strengthens in relation to the US dollar, emerging currencies go down, and vice versa.

- Dollar devaluation: the American currency Dx, devalues, when this happens the emerging currencies go down, when the Dx s strengthens, the emerging currencies rise:

Fundamentals Wednesday, October 13, 2021:

- Investors watch out for inflation data in the US and its impact on stock markets.

- Asian equity markets ended up and down, amid concerns about Evergrande and China’s real estate sector that are continuing.

- Shares in the US will open higher, before the September inflation data is known, which generates expectations in the market.

- Bitcoin falls to $ 55,000. For its part, Ethereum is trading at US $ 3,500.

- Oil prices fell on Wednesday on concerns that oil demand growth will fall as major economies suffer from inflation and supply chain problems.

Dollar For Today 11-13-2021:

COP: Bearish market closing at 3721.5 after a max 3765 and min 3718.05 with a volume of Us1.0 trillion. COP opened at 3719, and quickly reached a low of 3713 and then rose to 3731.

In the previous day, the USDCOP pair closed at $ 3,755.50 (- $ 11.85 compared to the previous close), after an opening at $ 3,765, a maximum level of $ 3,766 and a minimum level of $ 3,753. The volume traded reached $ 0.25bln and volatility of $ 13 pesos.

–

* This analysis does not represent a guarantee against the average value of the analyzed currency, nor its variations. Efinti is not responsible for any misinterpretation that may be made against the published article.