This information is based on statistical studies.

The COP is specifically governed by Drivers (Movements in Other Markets) and Fundamentals (News that are happening or that happen on the same market day).

3 Drivers that impact your performance on a daily basis:

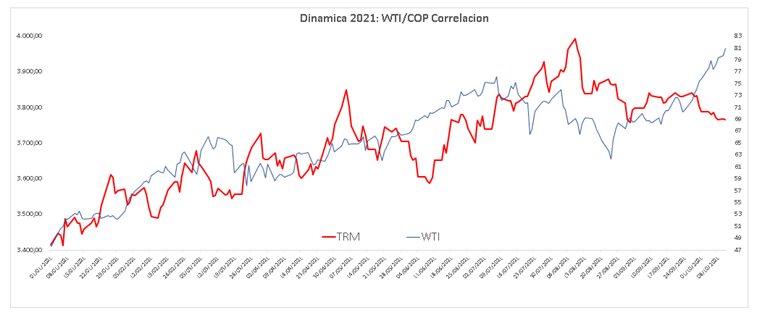

- WTI (Oil): When it rises, the COP falls and vice versa.

- Euro Vs. Usd: When the Euro strengthens in relation to the US dollar, emerging currencies go down, and vice versa.

- Devaluation of the Dollar: the American currency Dx, devalues, when this happens the emerging currencies go down, when the Dx s strengthens, the emerging currencies rise:

Fundamentals Friday October 15, 2021:

- Stock markets close the week on the rise despite inflation and rising oil.

- Asian stock markets ended the sessions with benefits on Friday, with the exception of the Bangkok stock exchange in Thailand, which closed in the red, amid an upward trend in major markets such as Hong Kong and Tokyo.

- European stocks were heading towards their best weekly performance in seven months as investors were encouraged by strong corporate results, which helped mitigate concerns about rising inflation.

- Shares in the US will open higher as the corporate earnings season continues to advance.

- Bitcoin is trading at $ 60,000. For its part, Ethereum stands at US $ 3,800.

- Oil prices hit a new three-year high on Friday, rising above US $ 85 a barrel on forecasts of a supply shortfall in the coming months as gas and coal prices skyrocketed, causing a surge. shift to petroleum products.

Dollar For Today 11-15-2021:

The dollar opened higher due to the expectation that the Fed will strengthen monetary policy

COP: Bull market with closing 3770.99 after a Highs 3774.45 and min 3735.90 with a volume of Us1.2 billion. COP opens at 3777, peaks at 85 and operates at 60.

In the previous day, the USDCOP pair closed at $ 3,745 (+ $ 23.5 compared to the previous close), after an opening at $ 3,719.90, a maximum level of $ 3,745 and a minimum level of $ 3,713.50. The volume traded reached $ 0.9 billion and volatility of $ 31.50 pesos.