This information is based on statistical studies.

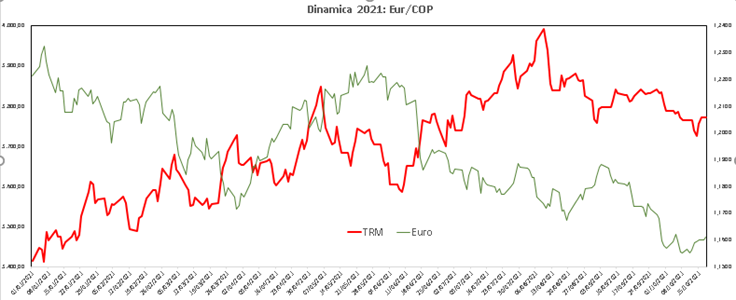

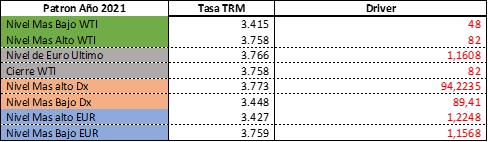

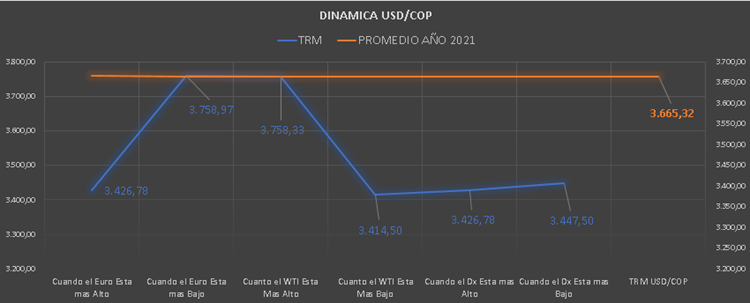

The COP is specifically governed by Drivers (Movements in Other Markets) and Fundamentals (News that are happening or that happen on the same market day).

3 Drivers that impact your performance on a daily basis:

- WTI (Oil): When it rises, the COP falls and vice versa.

- Euro Vs. Usd: When the Euro strengthens in relation to the US dollar, emerging currencies go down, and vice versa.

- Dollar devaluation: the American currency Dx, devalues, when this happens the emerging currencies go down, when the Dx s strengthens, the emerging currencies rise.

Fundamentals Wednesday, October 20, 2021:

- Stocks and oil suffer ups and downs, while bitcoin remains close to records.

- The Asian stock markets closed this Wednesday with mixed results in a day of little fluctuation in the stock indices and in which the most notable increases occurred in the places of the Philippines and Thailand.

- European stocks were lower on Wednesday after a disappointing earnings report from French luxury group Kering and a cold reception from Dutch semiconductor company ASML overshadowed strong results from Nestlé and others.

- Shares in the US will open slightly lower, after investors turn their attention to the cryptocurrency sector.This as the ProShares Bitcoin Strategy ETF debuted on Wall Street yesterday, giving a boost to the sector.

- Bitcoin remained below record levels. It rose to $ 63,998, but is still a small jump from its all-time high of $ 64,895.22, reached on April 14 of this year. For its part, Ethereum stands at US $ 3,800.

- Oil prices fell on Wednesday after the Chinese government stepped up its efforts to curb record high coal prices and ensure mines were operating at full capacity as Beijing moved to alleviate power shortages.

Dollar For Today 11-20-2021:

COP: Lateral market with closing 3766.80 after a maximum 3772 and a minimum 3753.80 with a volume of Us0.9 Billion. COP opens at 3755, and returns soon to 3770. There is still a decrease in cash in dollars and appetite to buy.

Dense market in pesos! And using dollars to fund pesos, generating a drop in the dollar cash, and therefore upward pressure.

–

* This analysis does not represent a guarantee against the average value of the analyzed currency, nor its variations. Efinti is not responsible for any misinterpretation that may be made against the published article.