This information is based on statistical studies.

The COP is specifically governed by Drivers (Movements in Other Markets) and Fundamentals (News that are happening or that happen on the same market day).

3 Drivers that impact your performance on a daily basis:

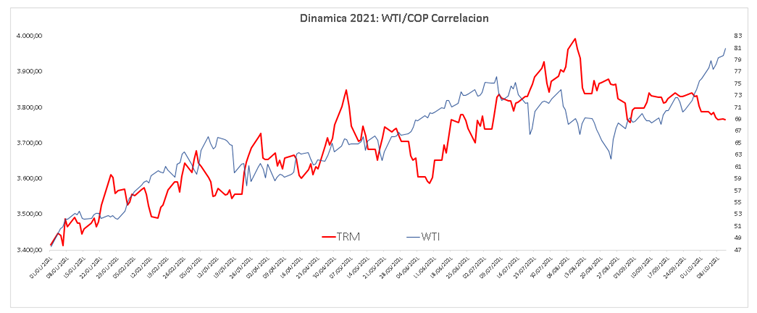

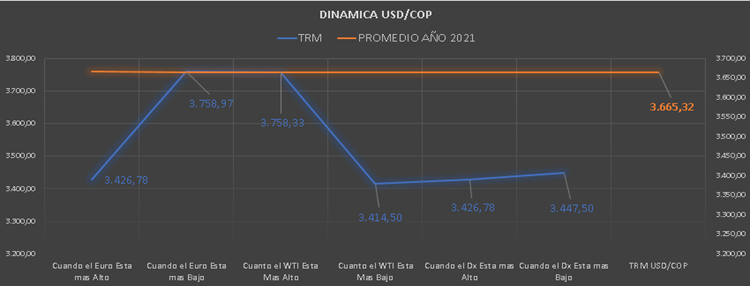

- WTI (Oil): When it rises, the COP falls and vice versa.

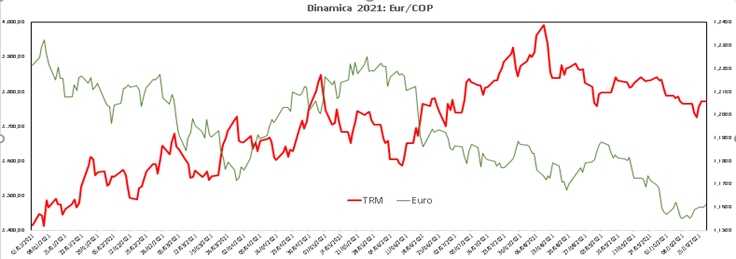

- Euro Vs. Usd: When the Euro strengthens in relation to the US dollar, emerging currencies go down, and vice versa.

- Dollar devaluation: the American currency Dx, devalues, when this happens the emerging currencies go down, when the Dx s strengthens, the emerging currencies rise

Fundamentals Thursday October 21, 2021:

- Premarket | Global stocks tumble on new fears for Evergrande and inflation.

- Asian equity markets closed Thursday with losses on new fears related to real estate giant Evergrande.

- European stocks fell on Thursday, weighed down by pessimism due to renewed concern about China’s real estate sector and mixed quarterly results.

- Shares in the US will open lower, following the trend seen in Asia and Europe on trading day.

- Yesterday bitcoin pulverized its all-time high in April and Ethereum is unstoppably approaching its May high (US $ 4,300).

- Oil prices hit a three-year high above $ 86 a barrel, fueled by tight supply and a global energy crisis, though they fell immediately as some investors took profits on signs that the rally appears exaggerated.

Dollar For Today 11-21-2021:

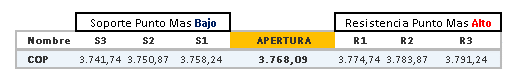

In the previous day, the USDCOP pair closed at $ 3,768.09 (+ $ 1.29 compared to the previous close), after an opening at $ 3,757, a maximum level of $ 3,776.55 and a minimum level of $ 3,757. The volume traded reached $ 1.21 billion and volatility of $ 19.55 pesos.

COP: Lateral market with closing 3768.09 after a maximum 3776.55 and min 3757 with a volume of Us1. 21 trillion.

–

* This analysis does not represent a guarantee against the average value of the analyzed currency, nor its variations. Efinti is not responsible for any misinterpretation that may be made against the published article.