This information is based on statistical studies.

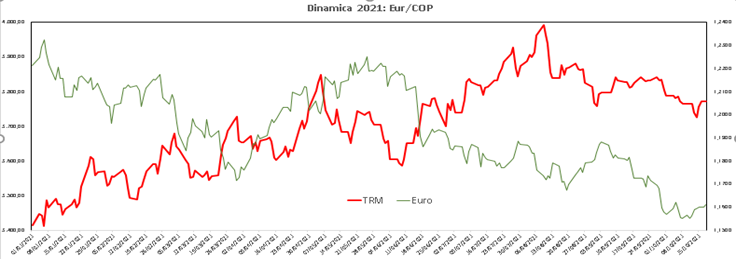

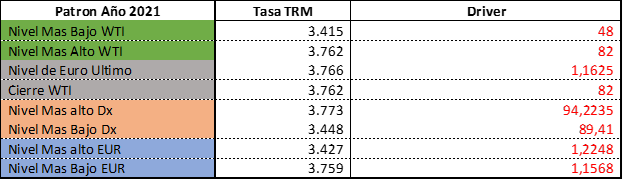

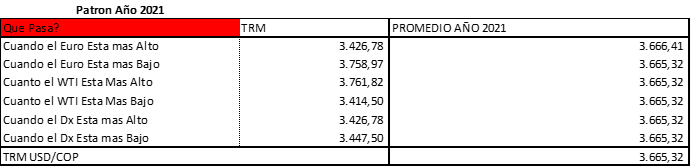

The COP is specifically governed by Drivers (Movements in Other Markets) and Fundamentals (News that are happening or that happen on the same market day).

3 Drivers that impact your performance on a daily basis:

- WTI (Oil): When it rises, the COP falls and vice versa.

- Euro Vs. Usd: When the Euro strengthens in relation to the US dollar, emerging currencies go down, and vice versa.

- Dollar devaluation: the American currency Dx, devalues, when this happens the emerging currencies go down, when the Dx s strengthens, the emerging currencies rise.

Fundamentals Monday October 25, 2021:

- Premarket | World stocks in mixed awaiting business results and ECB meeting.

- The main index of the Tokyo Stock Exchange, the Nikkei, closed this Monday with a drop of 0.71% due to the defeat of the ruling party in a regional election date one week before the general elections.

- The Spanish Stock Market was indecisive at the beginning of the day on Monday and had difficulty maintaining the level of 9,000 points, which it has lost and recovered on several occasions throughout the first three hours of trading, also affected by the business confidence data that fell again in October in Germany.

- US stock futures rose ahead of a big week of earnings from top tech companies.

- Oil prices extended their pre-weekend gains on Monday to hit multi-year highs, driven by tight global supply and strengthening demand for fuel in the United States and other countries as economies rebound from the low. crises caused by the pandemic.

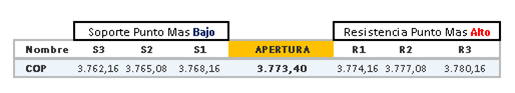

Dollar For Today 11-25-2021:

In the previous day, the USDCOP pair closed at $ 3,768 (- $ 13 compared to the previous close), after an opening at $ 3,783.50, a maximum level of $ 3,788 and a minimum level of $ 3,765.55. The volume traded reached $ 0.95bln and volatility of $ 22.45 pesos.

COP: Lateral market with closing 3768.09 after a maximum 3776.55 and min 3757 with a volume of Us1. 21 trillion.

–

* This analysis does not represent a guarantee against the average value of the analyzed currency, nor its variations. Efinti is not responsible for any misinterpretation that may be made against the published article.